Investor Information

At NADBank, we are committed to sustainable development by leveraging innovative, sound and responsible financial strategies. Our institution leverages it funds by issuing debt in international capital markets and partnerships with top-tier financial institutions.

This approach allows us to efficiently finance our lending activities and optimize our existing debt structure.

Our financial strength is based on three key pillars:

- Meticulous and prudent risk management.

- Rigorous lending and oversight processes that ensure the integrity of our operations.

- A robust liquidity policy that ensures financial soundness.

Credit ratings

FitchRatings

(Global scale)

AA/F1+ / stable

Moody's Investors Service

(Global scale)

Aa1/Prime-1 / negative

FitchRatings

(Local scale)

AAA(mex) / stable

Moody's Investors Service

(Local scale)

AAA(mex) / stable

Capitalization

NADBank is jointly capitalized by the Governments of the United States and Mexico.

Capital Structure

Subscribed capital is divided into paid-in and callable capital. Callable capital are shares that the Bank can request its shareholders pay under Chapter II, Article II, section 3(d) of its Charter.

50%

50%

Total subscribed capital

US$6.0 billion

Callable capital

US$5.1 billion

Paid-in capital

US$900 million

As defined in the Charter, the subscribed shares may be qualified or unqualified. Qualified shares are subject to the respective domestic legal requirements of each subscribing country. Unqualified shares have completed the domestic legal requirements and are available to the Bank.

In 1994, Mexico and the United States subscribed to 300,000 shares of capital stock with a par value of US$10,000 per share (US$3 billion), with equal commitments from each country. All shares from the initial subscription were unqualified as of May 2009.

In 2015, the member countries agreed to a general capital increase of 300,000 shares (US$3 billion), also with equal commitments from each government. Mexico and the United States submitted their letters of subscription on May 6, 2016, and September 1, 2016, respectively. The shareholders have until December 31, 2028, or such later dates as the Board of Directors shall determine, to unqualify all their subscribed shares.

For information on the current status of the subscribed capital, see the latest consolidated financial statements of Ordinary Capital Resources.

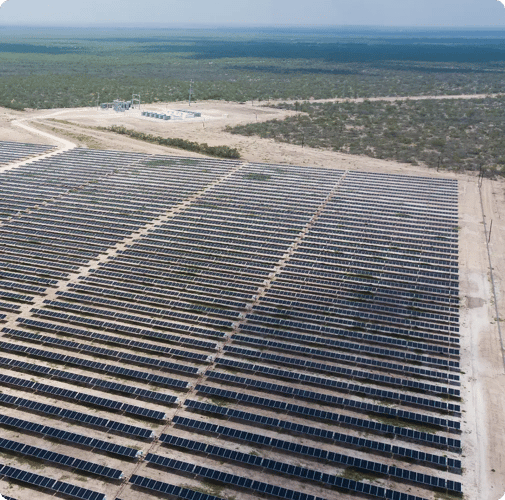

Sustainability Financing

NADBank’s Sustainable Financing Framework, validated by an independent second-party opinion from S&P Global Ratings, addresses critical development challenges in the border region, aligned with our environmental mandate. The framework supports initiatives such as water and waste management, renewable energy, sustainable urban development, and climate resilience, ensuring high governance standards, transparency, and significant environmental benefits.

To learn more about our framework and its impact, visit the Sustainability section.

Green Bond Issuances

As of December 31, 2023, we have issued three green bonds totaling US$478 million, and the proceeds have been fully allocated to 17 eligible projects. All the infrastructure projects financed with the proceeds of these bonds are comply with the NADBank Green Bond Framework, developed in 2018 and updated in 2020. The framework is consistent with the Green Bond Principles established by the International Capital Markets Association (ICMA) and received a positive second-party opinion.

More details about the NADBank Green Bond Program can be found in the 2023 Green Bond Report.

NADBank Green Bonds

(2018-2023)

Green Bond Maturing in 2026

Amount:

CHF 125 million

(equivalent to US$126 million)

Allocation:

6 renewable

energy projects

Green Bond Maturing in 2028

Amount:

CHF 180 million

(equivalent to US$186 million)

Allocation:

7 renewable

energy projects and 1 wastewater treatment project

Green Bond Maturing in 2033

Amount:

CHF 160 million

(equivalent to US$166 million)

Allocation:

9 projects

in the areas of sustainable energy, sustainable water management and pollution prevention and control

Distribution of proceeds

Total allocated:

US$436 million

(three issuances)

Distribution by sector:

- 91% renewable energy and energy efficiency

- 8% water-related projects

- 1% solid waste management

Financial Reports

Annual Reports

Green Bond Impact Reports

Ordinary Capital Resources Consolidated Financial Statements

Environment Investment and Capacity Facility (EICF) Financial Statements

NADBank Consolidated Financial Statements

Debt Issuance Information Statements