Managing ESG Risks

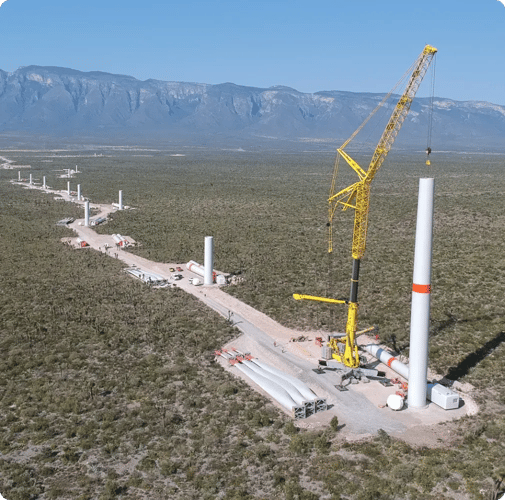

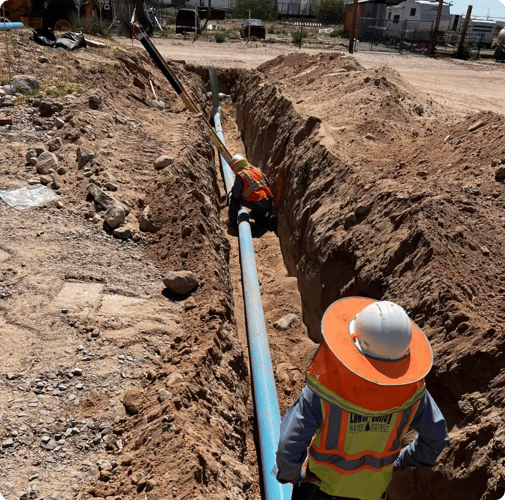

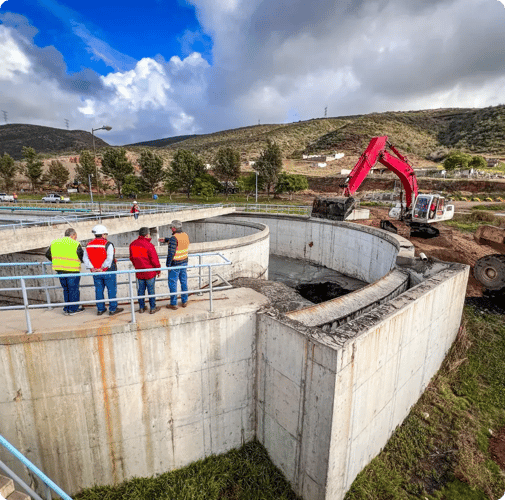

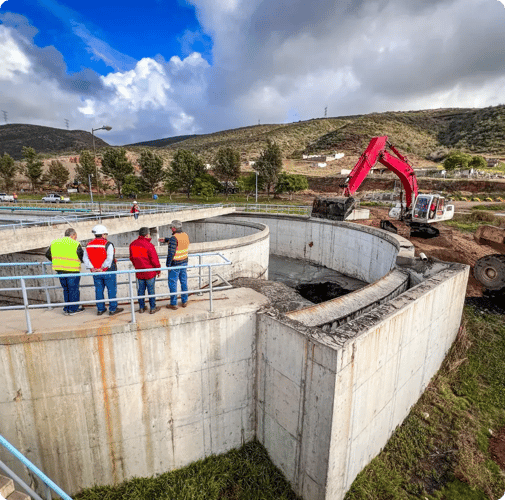

Responsible Projects

At NADBank, managing environmental, social, and governance (ESG) risks is essential to ensure our projects deliver sustainable and positive benefits for communities in the border region.

Using advanced tools and comprehensive strategies, we evaluate, mitigate, and manage ESG risks throughout the entire project lifecycle, promoting responsible and resilient development while ensuring alignment with high sustainability standards.

ESG Risk Management Systems

Our approach relies on advanced tools to manage ESG risks, ensuring each project aligns with sustainability objectives.

We apply a double materiality approach to evaluate both the impact of ESG factors on the project and the project’s impact on said factors.

Key Risk Management Tools

ESG

Risk Score:

- Numerical Rating: We assign a score from 1 to 5 to determine the ESG risk level each project faces.

- Project Prioritization: Facilitates project evaluation based on their relevance and ESG risk level.

- Early Risk Detection: We identify potential risks before they affect the project.

Environmental and Social Risk Management System (ESRMS):

- Risk Categorization: Projects are classified by risk level (high, medium, or low risk) to determine their potential environmental and social impacts and the intensity of the mitigation measures required.

- Customized Mitigation Plans: ESRMS enables tailoring specific strategies for each project, addressing risks based on their category and complexity.

- Ongoing Monitoring: We conduct continuous evaluations throughout the project lifecycle, adjusting the mitigation plan as new risks are identified.

Certification and Impact Measurement

At NADBank, all projects undergo a rigorous certification and impact evaluation process, promoting transparency and community participation.

Project Certification Process:

- Compliance with Technical and Environmental Criteria: Each project must meet strict technical feasibility and environmental sustainability standards.

- 30-day Public Consultation: Projects undergo a public comment period so that communities in the project area can provide feedback.

- Financial Evaluation: In addition to environmental criteria, projects are also evaluated financially to ensure long-term economic sustainability.

Continuous ESG Impact Measurement:

- Results Matrix: This matrix includes specific key performance indicators (KPIs) to measure project impacts in terms of ESG factors.

- Customized Indicators: The KPIs can be tailored to the characteristics of the projects, taking into account factors such as resource use, emissions and social benefits.

- Indicator Updates: The KPIs are periodically reviewed to reflect actual performance and to adjust the mitigation strategy if necessary.

Strategic Portfolio Management

At NADBank, we manage our project portfolio with a focus on ensuring environmental merit while fully and effectively identifying and addressing risks and opportunities.

Portfolio-Level ESG Risk Evaluation:

- Cumulative Risk Classification: Each project contributes to an overall ESG portfolio rating.

- Informed Investment Strategy: The aggregate risk assessment guides investment decisions to minimize exposure to critical risks.

- Impact Balance: Projects with high ESG impact are prioritized, achieving a balance between risk and benefits for communities.

Continuous Monitoring and Evaluation:

- Regular Reviews: We evaluate projects based on changes in social, environmental and regulatory conditions.

- Identification of New Risks and Opportunities:We analyze emerging events to adjust strategies for individual projects and the overall portfolio.

- ESG Performance Reviews: Each project undergoes semi-annual reviews to ensure alignment with ESG standards.

- Alignment with International Standards: The ESG evaluation methodology is adapted to sustainability standards established by the Sustainability Accounting Standards Board (SASB) and the International Finance Corporation (IFC), among others, keeping it up to date.